Starting your investment journey can feel like walking into a party where everyone knows the inside jokes but you. The charts look like abstract art, and terms like “ETF” and “short selling” sound like a foreign language. That hesitation is completely normal. Imagine if you could learn this stuff without feeling like you’re back in a classroom.

A handful of clever apps are now designed to do precisely that.

They’re swapping dense textbooks for interactive simulators and turning complex ideas into engaging puzzles. Let’s look at a few that are changing how we learn the rules of finance.

Finelo: The Personal Finance Coach That Plays Along

Finelo gets it. You don’t just want information; you want the confidence to use it. This platform feels like a personal coach for your money, designed specifically to take the intimidation out of finance.

Finelo.com skips the overwhelming video library. It first figures out what you need to know. The platform adjusts to your pace and what you want to learn, from crypto to basic budgeting. You get small daily tasks and short lessons that slowly add up. There’s also a built-in guide that explains things clearly whenever you have a question.

Their crown jewel is the investing simulator. This is your financial sandbox. You get to test strategies with virtual money on over 120 assets using real market data and interactive charts. It includes streaks, leaderboards, and daily goals that make practicing feel like a game. You can learn what a market dip actually feels like without the panic, building the muscle memory for investing before you ever risk a dollar.

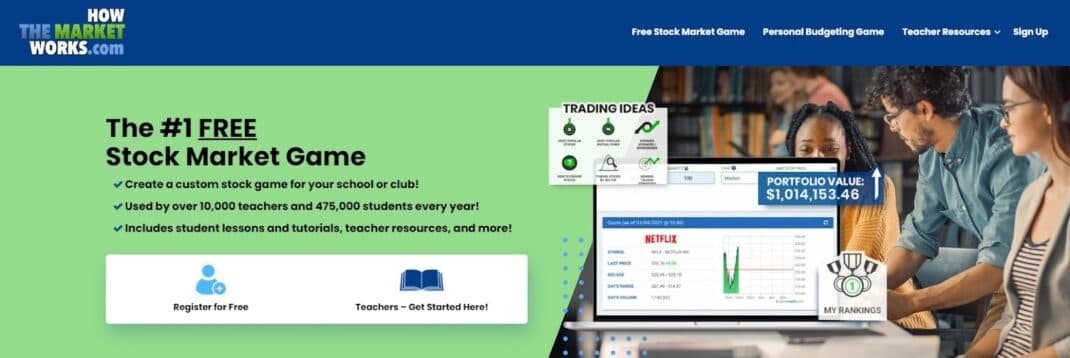

HowTheMarketWorks: The Classroom Veteran’s Playground

A trusted name for over two decades, HowTheMarketWorks is the seasoned teacher of the

bunch. Its strength is a straightforward, comprehensive approach that has made it a staple in countless schools and investment clubs.

This platform offers a deeply realistic trading experience. You can practice with stocks, mutual funds, and ETFs, all using current market prices. What makes it particularly valuable for a true beginner is its extensive Education Center. It’s packed with articles, glossaries, and investment tips that directly support what you’re practicing in the simulator.

The setup is simple, and it works. You can jump into public contests to see how your mock portfolio stacks up. This organized style suits you if you prefer a clear lesson plan. A little rivalry with other learners makes the whole process more engaging.

Invstr: Where Fantasy Sports Meets Your Portfolio

Invstr takes a uniquely social and playful approach. It’s built for the generation that grew up with fantasy sports leagues, applying that same competitive, community-driven spirit to the stock market.

The standout feature is “Fantasy Finance.” In this separate game, you get a million dollars in virtual money to build a portfolio. You earn points based on your portfolio’s real-life performance, competing against friends and the wider Invstr community on leaderboards. This completely separates the fun of learning and competing from the pressure of using your own money.

Once you’ve built confidence, Invstr also functions as a real brokerage, allowing you to start investing for real. The app seamlessly connects the educational game to actual practice, making that transition feel natural. With parental controls and a focus on community learning, it creates a supportive ecosystem for taking those first steps.

Brilliant.org: The “Why” Behind the “What”

For some, the numbers are the scariest part. Brilliant.org tackles this head-on. It builds your math muscles with interactive puzzles.

You won’t trade stocks here. Instead, you learn the logic behind investing. The platform teaches you about probability and statistics by having you solve problems. You don’t just hear about compound interest; you play with a tool that shows it growing.

This method sharpens your overall thinking. Brilliant pulls back the curtain on the math. You start to see risk and data differently. Later, a stock chart will look less like noise and more like a clear message.

Investopedia Simulator: Learn by Doing in a Risk-Free Bubble

Sometimes, you just need to dive in. The Investopedia Stock Simulator is one of the most well-known and accessible tools for this. It gives you a massive pile of virtual cash—$100,000—to experiment with in a live market environment.

The platform mirrors real-world trading without the financial danger. You can search for real stocks, see their current prices, and execute trades. It’s a sandbox where mistakes are free but the lessons are real. Losing virtual money on a bad trade teaches you about risk in a way a textbook never could.

What makes it so valuable for beginners is its simplicity and direct connection to Investopedia’s vast library of educational content. If you encounter a term like “ETF” or “short selling” while building your portfolio, a quick search on the site gives you an immediate, clear explanation.

This tight loop between action and learning helps demystify the process. It turns abstract concepts into something you have personally experienced in your own simulated portfolio.

The Jargon Barrier: Speaking the Language

Often, the hardest part is just understanding the words. Finance has its own dialect full of confusing shortcuts. This specialized language builds a wall right away. Reading a simple market update can feel like deciphering a secret code.

This “vocabulary wall” is a real source of anxiety. Hearing about a “bear market” or “liquidity” can make you feel like an outsider. The good news is you don’t need an MBA. You just need these concepts translated.

It’s similar to picking up any new craft. You can’t get far in woodworking if you don’t know what a mitre joint is.

The key is to learn in context.

A platform that explains “short selling” not with a textbook definition, but by showing you a simple scenario in a simulator, makes that term stick. It moves the word from an abstract concept to a concrete action you can understand. The tools we’ve discussed build this understanding naturally, turning confusing jargon into clear ideas through hands-on experience.

Final Thoughts: Your Game Plan to Confidence

The path to becoming a confident investor doesn’t have to be boring or scary. These platforms prove that understanding the landscape is your most valuable initial deposit.

Find one that fits how you like to learn.

If you love competition, dive into Invstr’s fantasy leagues. If you prefer a structured, educational path, HowTheMarketWorks is your guide. If you want a personalized coach and a safe space to practice, Finelo is ready for you.

The goal is to build your confidence one trade, one challenge, one puzzle at a time. With these gamified tools, you’re not just reading about the market—you’re learning by doing, turning fear into familiarity and finally, into capability.